Financial Results

We commit to be a responsible industry leader by leveraging on the strengths of our people, processes, and technologies to create value for our stakeholders.

Find financial news, results, and key performance ratios here, readily available at your fingertips.

Condensed Interim Financial Statements For the Six-Month Period Ended 31 December 2025 (“1H2026”)

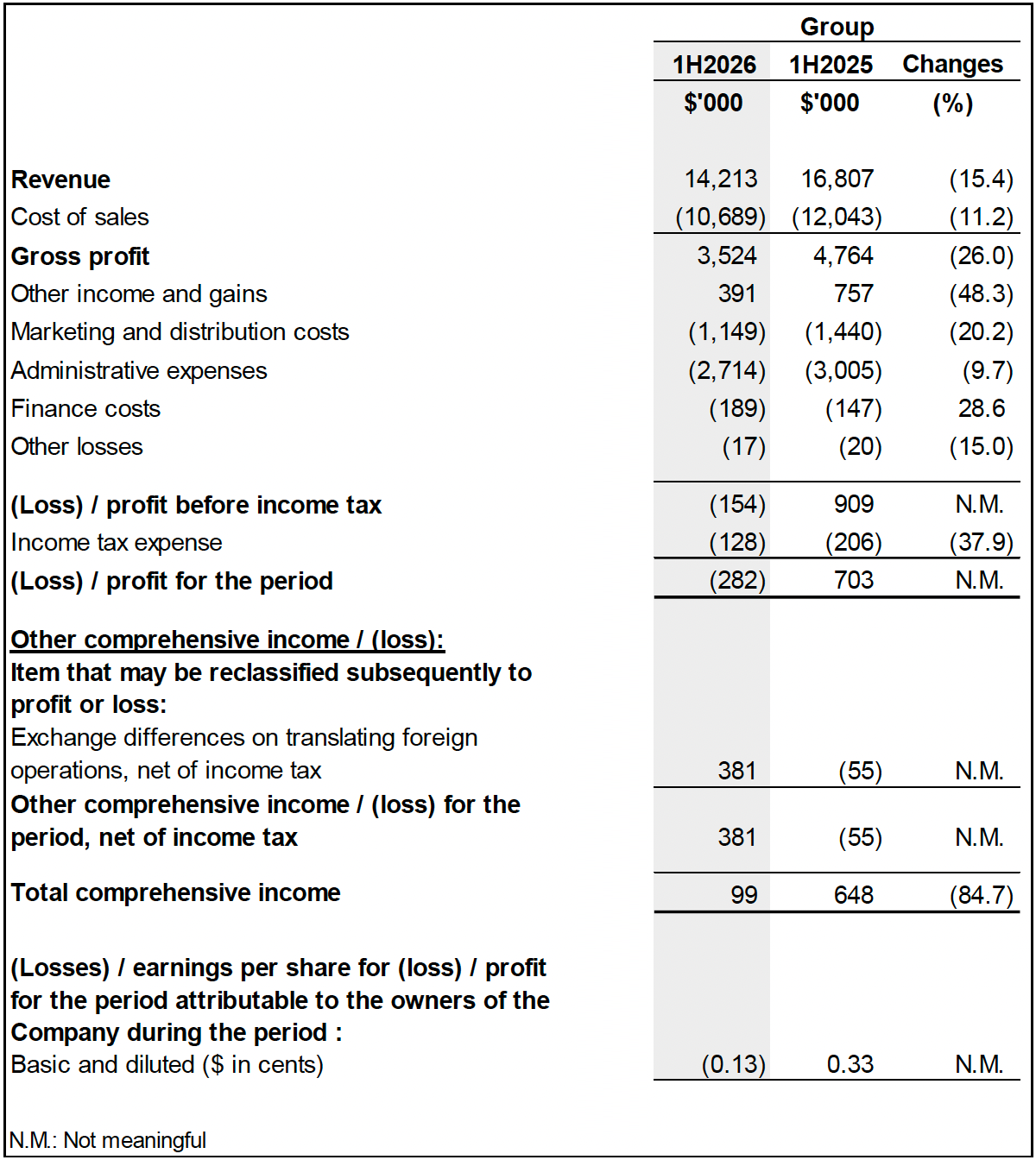

Profit or Loss

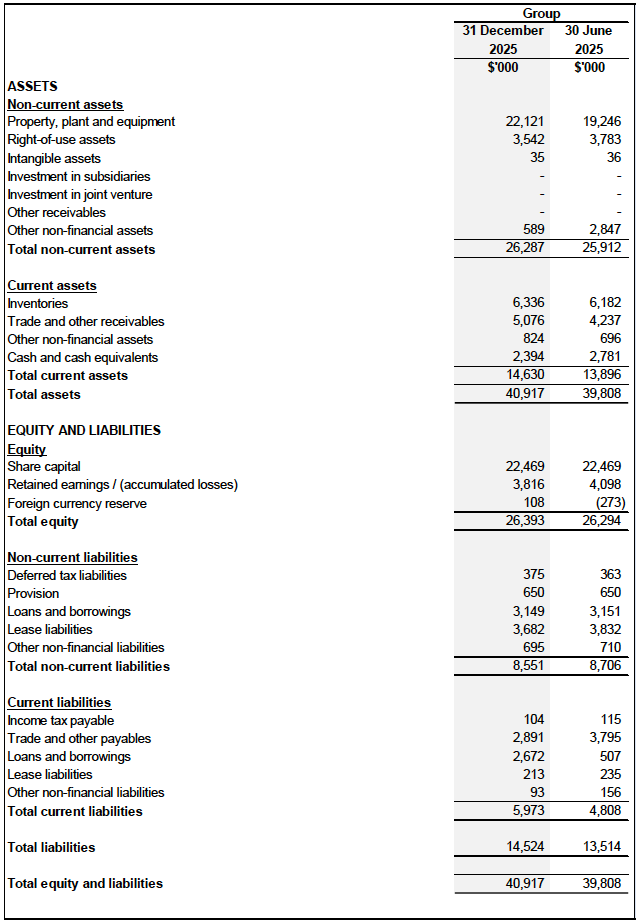

Balance Sheet

Review of Performance

Statement of Comprehensive Income

Revenue

Business Segments:

Revenue decreased by approximately $2.6 million, or 15.4%, from $16.8 million in 1H2025 to $14.2 million in 1H2026 mainly due to lower sales across all the segments, except for the Food Services segment.

- Modern Trade Segment: Revenue declined by approximately $0.2 million, or 5.3%, from $3.8 million in 1H2025 to $3.6 million in 1H2026, largely attributable to subdued consumer sentiment and intensified competition from house brands amid a wider range of product offerings in the market.

- General Trade Segment: Revenue decreased by approximately $0.2 million, or 5.1%, from $5.0 million in 1H2025 to $4.8 million in 1H2026, mainly due to lower demand from customers in Singapore.

- Food Services Segment: Revenue remained stable at approximately $3.9 million in both 1H2025 and 1H2026.

- Others Segment: Revenue decreased significantly by approximately $2.1 million, or 54.0%, from $4.0 million in 1H2025 to $1.9 million in 1H2026, primarily due to lower sales generated from the export segment.

Geographical Information:

- Singapore Market: Revenue decreased by approximately $0.5 million, or 4.8%, from $10.9 million in 1H2025 to $10.4 million in 1H2026, reflecting weaker consumer demand across all segments.

- Malaysia Market: Revenue increased by approximately $0.3 million, or 13.5%, from $2.2 million in 1H2025 to $2.5 million in 1H2026, mainly driven by higher demand in the General Trade and Modern Trade segments.

- Other Markets: Revenue declined by approximately $2.4 million, or 64.3%, from $3.7 million in 1H2025 to $1.3 million in 1H2026, due to lower export sales arising from evolving overseas market dynamics and changes in customers’ order patterns.

Cost of Sales:

Cost of sales decreased by approximately $1.3 million, or 11.2%, from $12.0 million in 1H2025 to $10.7 million in 1H2026, in line with the lower sales.

Gross Profit and Gross Profit Margin:

Gross profit decreased by approximately $1.3 million, or 26.0%, from $4.8 million in 1H2025 to $3.5 million in 1H2026. Gross profit margin declined from 28.3% in 1H2025 to 24.8% in 1H2026, mainly due to lower production volume resulting from reduced sales.

Other Income and Gains:

Other income and gains decreased by approximately $0.4 million, or 48.3%, from $0.8 million in 1H2025 to $0.4 million in 1H2026. The decrease was mainly due to lower foreign exchange translation gains of approximately $0.4 million arising from the appreciation of the Malaysian Ringgit (“MYR”) against Singapore Dollar (“SGD”) in respect of SGD-denominated loans extended to the Group’s subsidiary in Malaysia for its factory set-up. The lower exchange gain recognised in 1H2026 was also due to the deduction in SGD loan balances following the conversion of these loans into equity as additional investment in the wholly-owned subsidiary.

Expenses

- Marketing and Distribution Costs: Decreased by approximately $0.3 million, or 20.2%, from $1.4 million in 1H2025 to $1.1 million in 1H2026, mainly due to lower advertising and promotional spending, in line with reduced sales.

- Administrative Expenses: Decreased by approximately $0.3 million, or 9.7%, from $3.0 million in 1H2025 to $2.7 million in 1H2026, primarily due to the absence of December performance bonuses in 1H2026 as part of cost-cutting measures and the higher costs incurred in 1H2025 to set up the newly-acquired manufacturing facility in Johor, Malaysia.. The facility has yet to fully ramp up operations as of date, as several certifications and approvals from local authorities remain pending and are currently expected to be completed in due course.

- Finance Costs: Increased by approximately $42,000, or 28.6%, from $0.1 million in 1H2025 to $0.2 million in 1H2026, mainly due to new bank borrowings drawn down during the period.

- Other Losses: Decreased by approximately $3,000, or 15.0% from $20,000 in 1H2025 to $17,000 in 1H2026. The decrease was mainly due to reversal of impairment of trade receivables.

Income Tax Expense:

Income tax expenses decreased by approximately $0.1 million, or 37.9%, from $0.2 million in 1H2025 to $0.1 million in 1H2026, mainly due to lower profit before income tax from subsidiaries in Singapore and Malaysia during the period.

(Loss) / profit for the period:

As a result of the above, the Group recorded a loss after tax of approximately $0.3 million in 1H2026, compared to a profit after tax of $0.7 million in 1H2025.

Statement of Financial Position

The comparative commentary for both the assets and liabilities are based on the Group’s financial statements as at 31 December 2025 and 30 June 2025.

Non-current Assets

Non-current assets increased by approximately $0.4 million, from $25.9 million as of 30 June 2025 to $26.3 million as of 31 December 2025.

Property, plant and equipment (“PPE”) increased by approximately $2.9 million, from $19.2 million as of 30 June 2025 to $22.1 million as at 31 December 2025. This increase was primarily attributable to additions of approximately $3.2 million relating to renovation works, machinery and equipment acquired for the newly set-up manufacturing facility in Malaysia, as well as an exchange translation gain of $0.6 million arising from acquisition cost denominated in MYR following the strengthening of MYR against SGD. These increases were partially offset by depreciation charges of approximately $0.9 million during the period.

Right-of-use assets decreased by approximately $0.2 million, from $3.8 million as of 30 June 2025 to $3.5 million as of 31 December 2025, mainly due to depreciation charges of approximately $0.2 million and the early termination of a lease by a subsidiary amounting to approximately $0.1 million.

Other non-financial assets decreased by $2.3 million from $2.8 million as at 30 June 2025 to $0.6 million as at 31 December 2025. The reduction was mainly due to the reclassification of renovation works from Other non-financial assets to PPE upon the completion of renovation works as at 31 December 2025.

Current Assets

Current assets increased by approximately $0.7 million, from $13.9 million as at 30 June 2025 to $14.6 million as at 31 December 2025. This increase was primarily due to an increase in trade and other receivables of approximately $0.8 million due to sales in the December festive period, an increase in inventories of approximately $0.2 million and an increase in other non-financial assets of approximately $0.1 million, partially offset by a decrease in cash and cash equivalents of approximately $0.4 million.

The decrease in cash and cash equivalents is further explained in the Cash Flows Statement section.

Non-current Liabilities

Non-current liabilities decreased by approximately $0.1 million, from $8.7 million as at 30 June 2025 to $8.6 million as at 31 December 2025, mainly due to a reduction in lease liabilities of approximately $0.1 million.

Current Liabilities

Current liabilities increased by approximately $1.2 million, from $4.8 million as at 30 June 2025 to $6.0 million as at 31 December 2025. The increase was mainly attributable to an increase in loans and borrowings of approximately $2.2 million. The increase in the loans and borrowings was primarily due to a new loan of $2.0 million obtained from directors of the Company during the current financial period, as well as an increase in bank borrowings of approximately $0.2 million arising from foreign translation of MYR-denominated borrowings, following the strengthening of MYR against the SGD.

This is partially offset by a decrease in trade and other payables of approximately $0.9 million, reflecting lower production volumes in line with lower sales and a deduction in other non-financial liabilities of approximately $0.1 million.

Statement of Cash Flows

The Group recorded net cash outflows from operating activities of approximately $1.2 million. This was mainly attributable to an operating cash inflow before working capital changes of approximately $1.0 million, offset by net working capital outflows of approximately $2.1 million and tax payments of approximately $0.1 million.

The net working capital outflows were primarily due to an increase in trade and other receivables of approximately $0.8 million, an increase in inventories of approximately $0.2 million, an increase in other non-financial assets of approximately $0.1 million, a reduction in trade and other payables of approximately $0.9 million and a reduction in other non-financial liabilities of $31,000.

Net cash used in investing activities amounted to approximately $0.9 million, mainly due to the purchase of property, plant, and equipment of approximately $0.9 million.

Net cash from financing activities amounted to approximately $1.7 million, mainly due to the new borrowing from the directors of the Company of $2.0 million and new bank borrowings by a subsidiary of approximately $1.5 million, which were partially offset by the repayment of loans and borrowings amounting to approximately $1.5 million, payment of lease liabilities of approximately $0.2 million and interest paid of approximately $0.1 million.

As a result of the above, the cash and cash equivalents decreased by approximately $0.4 million, bringing the balance to $2.4 million as at 31 December 2025.

Commentary

Operating conditions remain challenging, with the Group continuing to contend with elevated cost levels and a highly competitive retail landscape. Inflationary pressures have driven up raw material, labour and operating expenses, while intensified competition — particularly from supermarkets’ own private-label offerings — has further constrained pricing flexibility.

Beyond the immediate operating environment, broader global uncertainties continue to cloud the outlook. Geopolitical developments in the Middle East and Ukraine, ongoing US tariff policies, sustained high global meat prices and increased freight costs have collectively impacted supply chains and market sentiment.

In navigating these headwinds, the Group has prioritised disciplined execution across its core business functions. Cost controls have been tightened across operations, alongside efforts to improve production efficiency and optimise distribution processes. At the same time, the Group maintained core marketing and sales initiatives to support brand visibility and outreach, while exercising tighter control over marketing cost, which were lower than the prior financial year.

Looking ahead, the Group is also progressing with its longer-term capacity strategy, including preparations for the full operational commencement of its new manufacturing facility in Malaysia. Taken together, these initiatives are intended to reinforce operational resilience and lay the groundwork for sustainable growth, with benefits expected to accrue progressively over time.